European Vanilla Bean Sales Projected to Reach USD 4 Billion by 2035 — Natural Flavor Demand Drives Growth Across Europe

The European Union is witnessing a strong rise in demand for vanilla beans, driven by growing use in food, beverages, and premium flavor products.

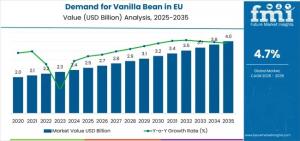

NEWARK, DE, UNITED STATES, November 11, 2025 /EINPresswire.com/ -- The European vanilla bean market is poised for robust growth, with sales expected to rise from USD 2.5 billion in 2025 to approximately USD 4 billion by 2035, representing a total increase of USD 1.4 billion. The market is set to expand at a compound annual growth rate (CAGR) of 4.7% over the decade, underpinned by rising demand for natural flavoring ingredients, clean-label products, and innovative applications across food manufacturing and retail sectors.

Get Exclusive Access To Data Tables, Market Sizing Dashboards, And Analyst Insights. Request Sample Report. https://www.futuremarketinsights.com/reports/sample/rep-gb-27176

Between 2025 and 2030, vanilla bean sales are projected to climb from USD 2.5 billion to USD 3.1 billion, contributing 44.8% of total growth during this period. This phase is fueled by consumer preference for natural over synthetic flavoring, widespread availability of extract and whole bean formats, and growing acceptance of premium natural ingredients in mainstream food production.

From 2030 to 2035, the market is expected to increase by USD 808.3 million, marking 55.2% of the decade’s growth. Growth drivers include organic and fair-trade varieties, adoption of traceability technologies for supply chain transparency, and innovative vanilla applications targeting diverse food and beverage segments. Ethical sourcing and consumer willingness to pay for premium products are further accelerating the market.

Historical Growth and Industry Drivers

The EU vanilla bean market grew steadily between 2020 and 2025 at a CAGR of 4.7%, rising from USD 2 billion to USD 2.5 billion. This expansion was driven by:

• Rising demand for natural ingredients among food manufacturers

• Increased awareness of clean-label benefits

• Vanilla’s versatility across bakery, confectionery, and dairy applications

Industry experts highlight that major flavor houses and vanilla processors have leveraged advanced extraction techniques, supply chain improvements, and product innovations to build consumer confidence and mainstream acceptance.

Segmental Insights

• By Product Type: Extract formats dominate with 65% share in 2025, projected to increase to 66.5% by 2035. Benefits include:

o Efficient integration into industrial food production

o Consistent flavor delivery

o Extended shelf life

• By Application: Food applications account for 65% of demand, slightly decreasing to 62% by 2035 due to faster growth in beverages and pharmaceuticals. Key drivers include:

o Premium positioning for product differentiation

o Consumer preference for natural flavoring

o Versatility across multiple food categories

• By Distribution Channel: Supermarkets and hypermarkets control 38% of sales, with online channels growing from 15% to 22% by 2035, reflecting evolving consumer purchasing habits.

• By Nature: Conventional products hold 85% market share in 2025, declining to 80% by 2035 as organic and ethically sourced variants gain traction.

Regional Insights

• Germany: Largest market with 28.3% share, CAGR 4.4% through 2035, driven by quality-conscious consumers and established food manufacturing.

• France: CAGR 4.8%, fueled by strong culinary heritage and premium bakery traditions.

• Italy: CAGR 4.9%, supported by artisanal food and gelato sectors.

• Spain: Fastest growth at 5% CAGR, led by expanding food manufacturing and confectionery production.

• Netherlands: Slight decline at -2% CAGR due to market consolidation.

• Rest of Europe: CAGR 4.5%, reflecting steady adoption of premium ingredients.

Market Trends and Opportunities

Growth is reinforced by:

• Expansion of traceability technologies and blockchain-enabled supply chains

• Integration of fair trade and organic certifications

• Innovations in extraction technology and flavor optimization for confectionery and beverage applications

Challenges include price volatility, weather-dependent supply, and competition from synthetic vanillin. Nonetheless, sustainable sourcing and transparent supply chain initiatives remain central to market development.

Competitive Landscape

Leading players include:

• Givaudan – 12% share, leveraging global flavor leadership and technical expertise

• Symrise – 10% share, strong European manufacturing footprint

• Eurovanille S.A. – 6% share, specializing in traceable vanilla processing

• McCormick & Company – 4% share, retail brand recognition and extract expertise

Other regional processors and ingredient distributors account for 68% of the market, emphasizing diverse sourcing, niche applications, and premium product differentiation.

To Access The Full Market Analysis, Strategic Recommendations, And Analyst Support, Purchase The Complete Report Here. https://www.futuremarketinsights.com/checkout/27176

Conclusion

The European vanilla bean market is evolving rapidly as natural, premium, and ethically sourced ingredients gain prominence. With sustainable sourcing, traceable supply chains, and flavor innovation at the forefront, the market is well-positioned to achieve significant growth, reaching USD 4 billion by 2035.

Browse Related Insights

Vanilla Bean Market: https://www.futuremarketinsights.com/reports/vanilla-bean-market

Korea Vanilla Bean Market: https://www.futuremarketinsights.com/reports/vanilla-bean-industry-analysis-in-korea

Why FMI: https://www.futuremarketinsights.com/why-fmi

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.